Government Balances Economic Intervention Following Bank Failures

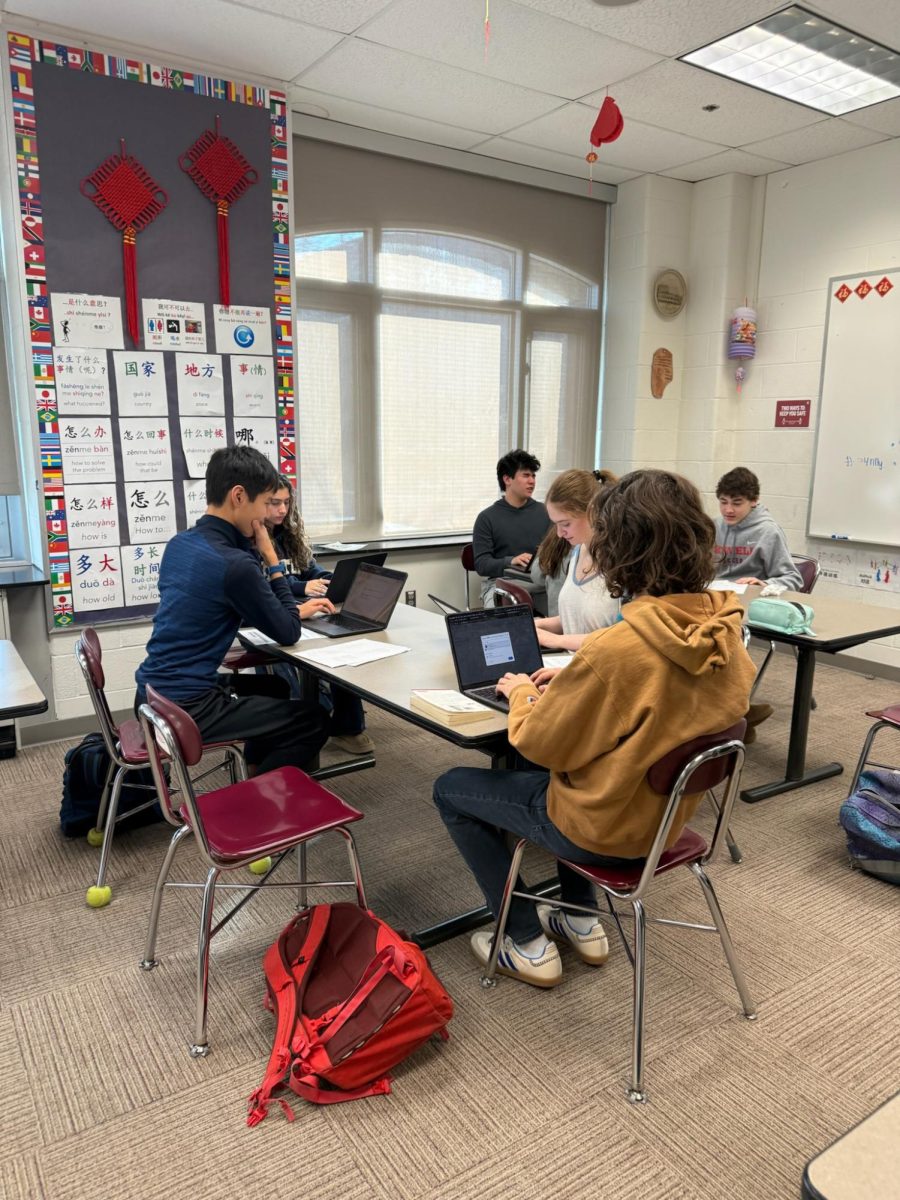

The recent Silicon Valley Bank failure has prompted debates over the level of federal intervention in banking. Photo: Justin Sullivan via Getty Images.

The U.S. is currently experiencing an economic recession caused by high rates of inflation which has severely impacted the banking sector. The collapse of Silicon Valley Bank (SVB) this past March was the second largest bank collapse in history, with the subsequent failure of Signature Bank being the third. First Republic Bank’s stock has reached its lowest point, and, internationally, Credit Suisse only narrowly averted a similar financial catastrophe with a $54 billion bailout by the Swiss Central Bank, according to The New York Times. In the wake of such challenges, economists and critics of American financial policy have renewed concerns about the appropriate amount of federal intervention needed to best stabilize the economy.

The largest bank closure since the 2008 financial crisis, SVB’s failure seems to be the culmination of numerous factors, especially high interest rates that were increased to combat rising inflation. Amidst the crisis, other banks attempted to avoid the same fate as SVB by acquiring support funding from the Federal Reserve and JPMorgan Chase. In his remarks on March 13, President Joe Biden promised Americans that “all customers who had deposits in these banks can rest assured they’ll be protected and they’ll have access to their money,” emphasizing a commitment to managing the crisis and preventing losses for individual Americans. A joint statement from the Treasury Department, Federal Reserve and Federal Deposit Insurance Corporation corroborated this statement, announcing the government’s plan to reimburse depositors and “ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.”

As seen with the actions taken by previous U.S. administrations, limited government interference in a free market economy can occasionally help reimburse bank clients and aid other systemically essential industries, thus helping to avoid economic crises and improving economic equity. Otherwise, excessive government intervention may be detrimental to the economy as a whole, as political strategy interferes in crucial financial decisions. Since the American economy traditionally operates on a liberal model with laissez-faire policies, a sudden and extreme shift to mitigate economic fluctuations may prove counterproductive. As a result, the costs associated with heavy government involvement may actually exceed the overall economic gain. In response to the recent string of bank failures, the government’s restrained reaction will likely prove beneficial to the economy, as refunding full losses preserves the American people’s faith in the banking system and protects smaller banks from following suit in the ensuing panic.

The government response to the current banking crisis has, therefore, been appropriate and displays a well-balanced level of federal intervention in the economy.